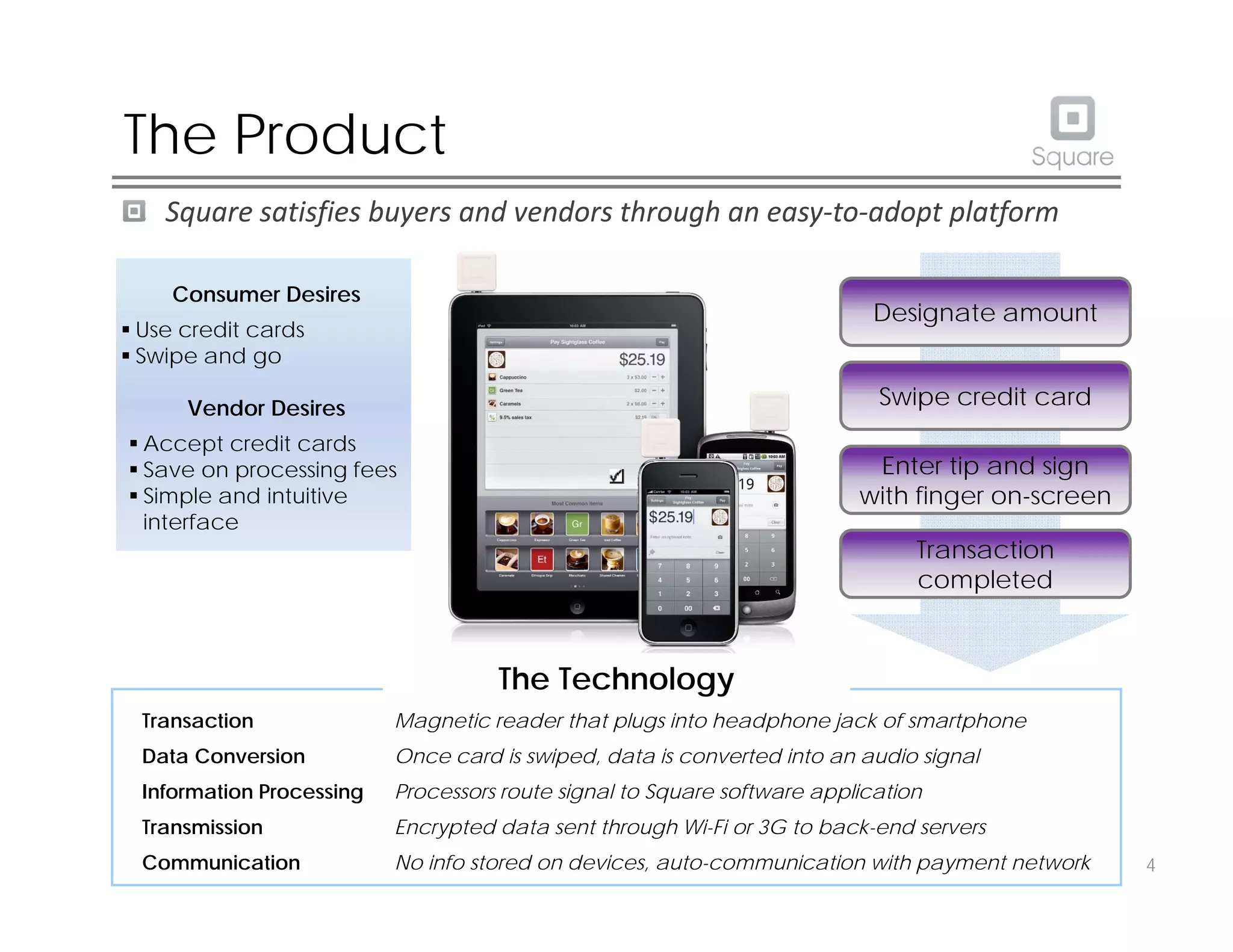

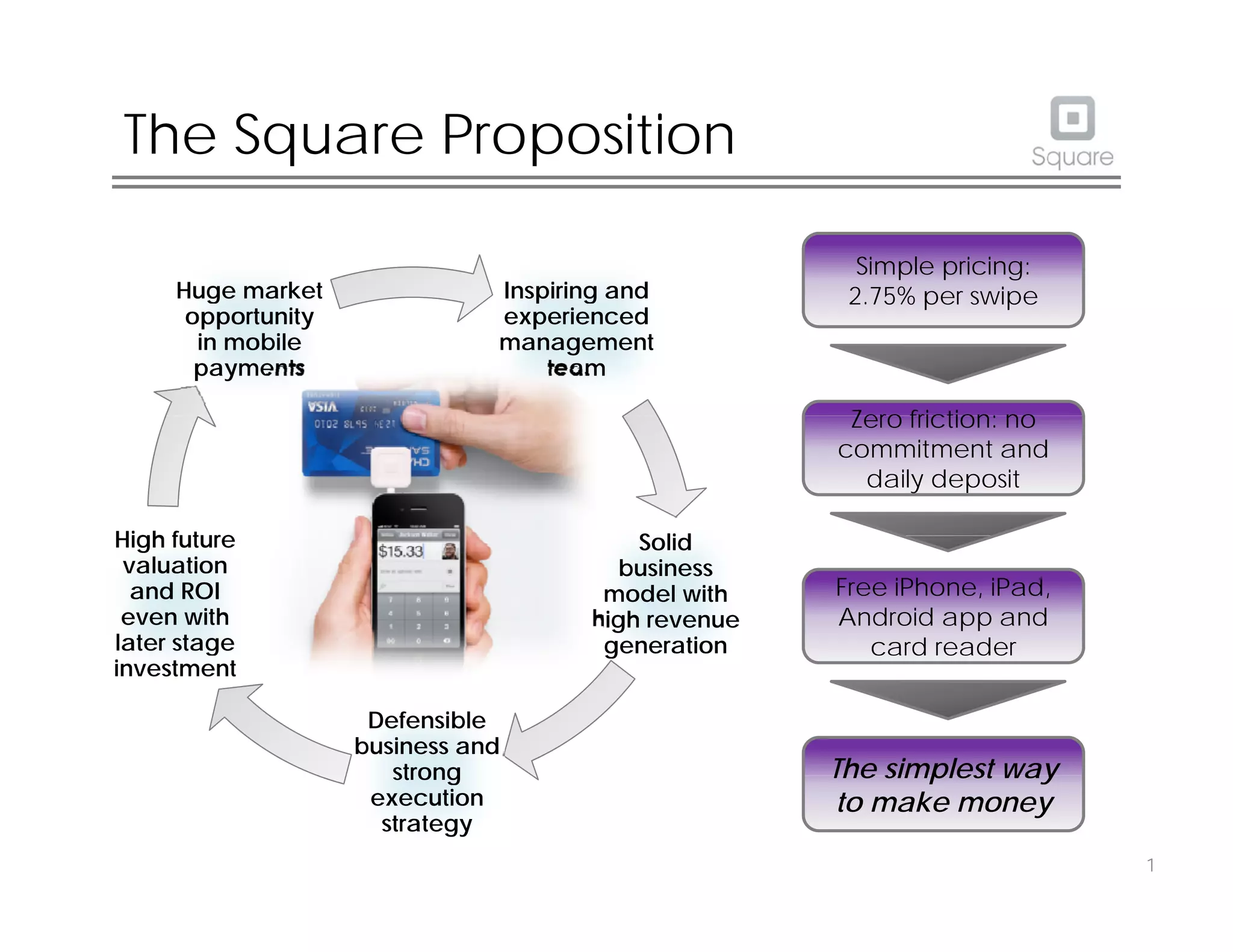

The Proposition: Clear, simple value (slide: product & pricing)

Slide analyzed: The Square Proposition (SLIDE 2) uses a visual center (card reader + phone) surrounded by a concise value-cycle and a right-hand column that reduces the offering to three simple bullets: simple pricing (2.75%), zero friction (no commitments/daily deposits), and free hardware. This layout makes the product both tangible (you can picture the card reader) and immediately attractive to merchants (transparent fees + free device). The circular arrows around the image imply defensibility and compounding value (team → business model → valuation), which frames the product as both practical and investable.

What founders can learn: start with one clean, visual value proposition and lead with the simplest commercial terms your customers care about. The slide is effective because it answers “what is it?”, “how does it make money?”, and “why is it defensible?” in one glance. Use an actual product image, boil pricing and friction down to a few words, and show a concise path from product to return so investors can quickly connect product-market fit to monetization.