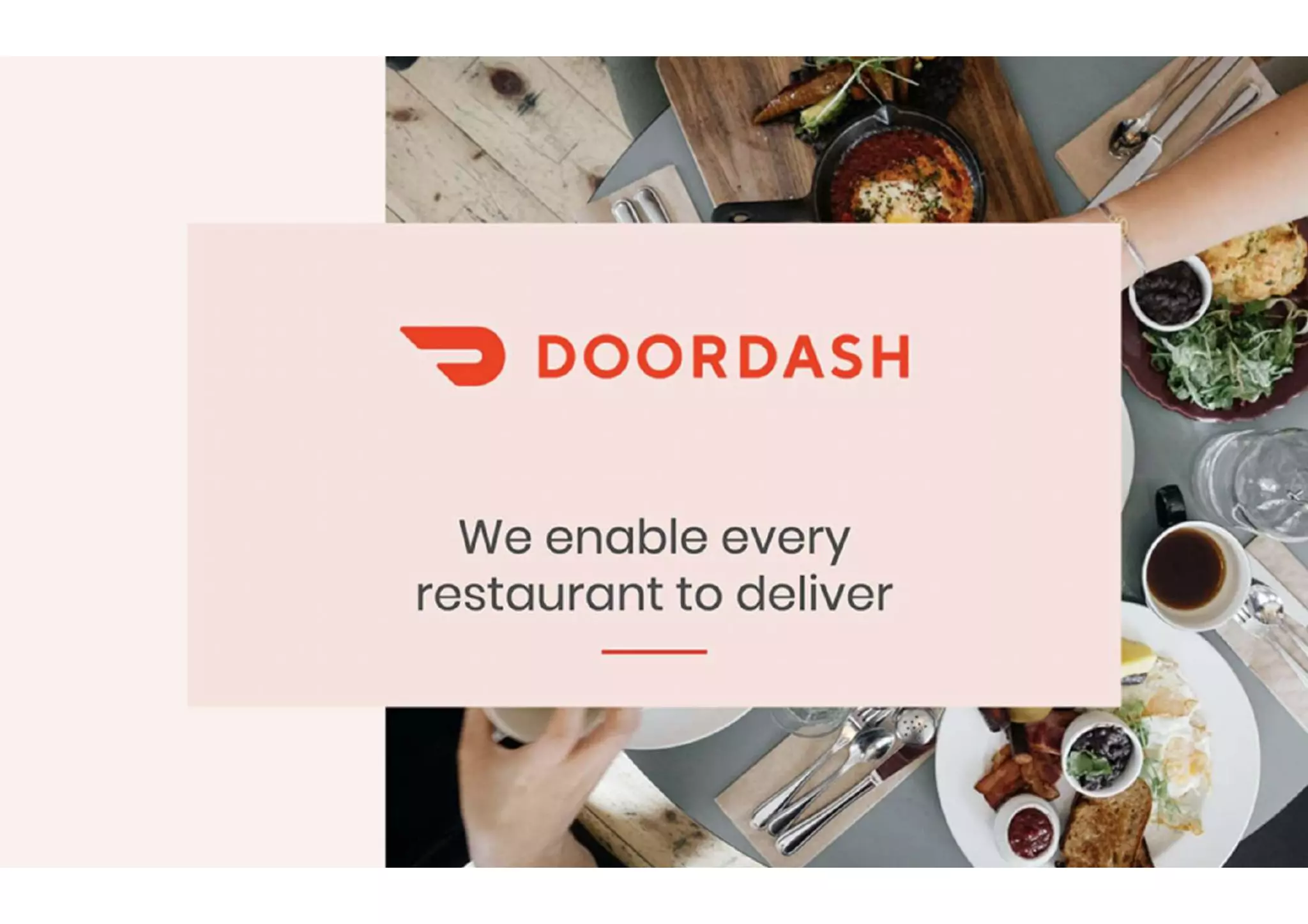

The Opening: Clear value proposition and brand

The first slide immediately states the company name and a one-line mission: "We enable every restaurant to deliver." It uses large type, minimal copy, and lifestyle photography to establish context (food, restaurants) while making the promise explicit and easy to remember. This is effective because investors instantly understand the target customer (restaurants) and the service outcome (deliveries) without having to parse jargon.

For founders, the lesson is to lead with a crisp value proposition that names who you serve and what you do. The visual treatment here supports the message — clean typography, strong logo placement, and relevant imagery help create an emotional as well as rational hook. There's no filler; the slide does the job of orienting the audience in seconds.