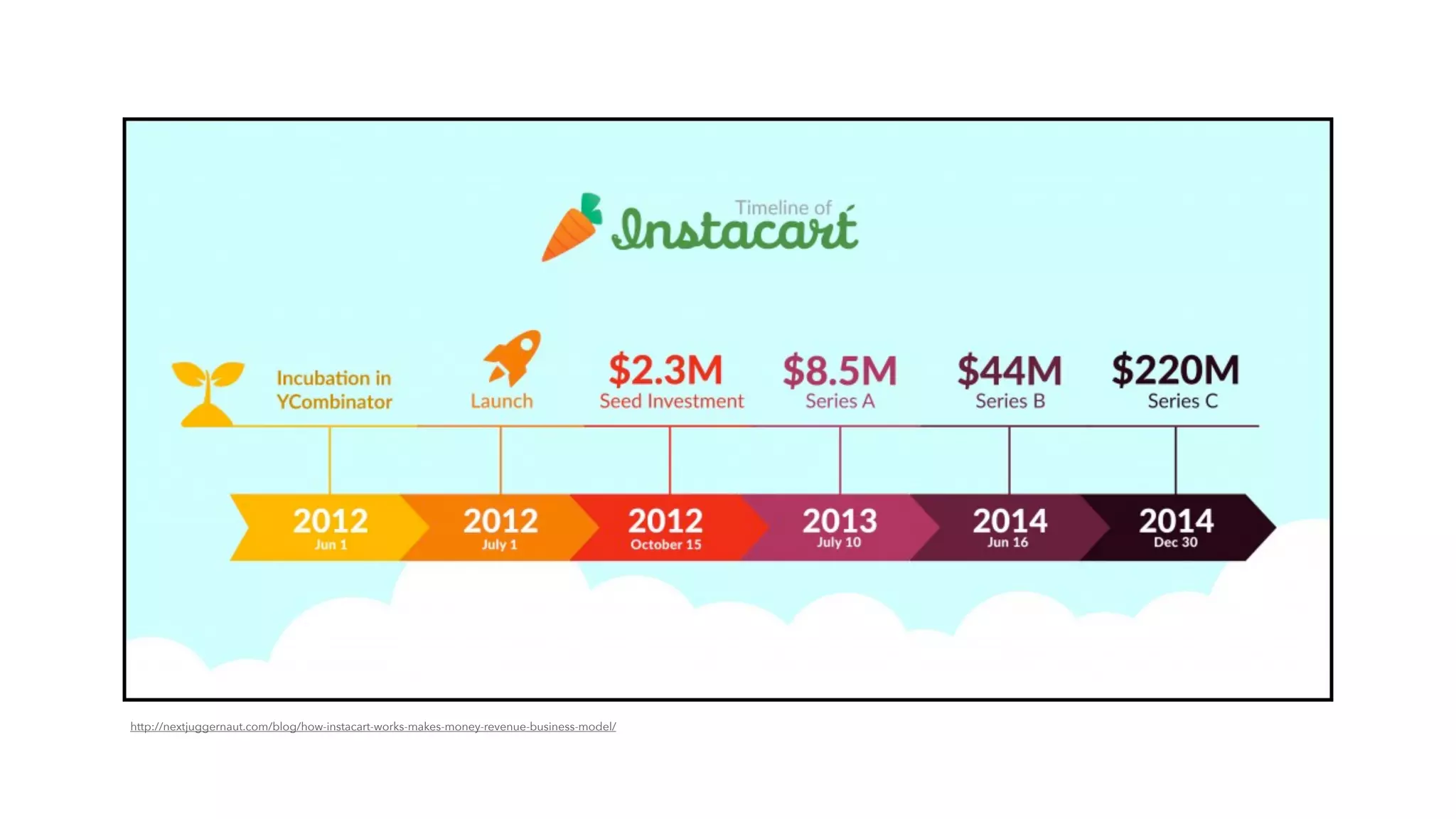

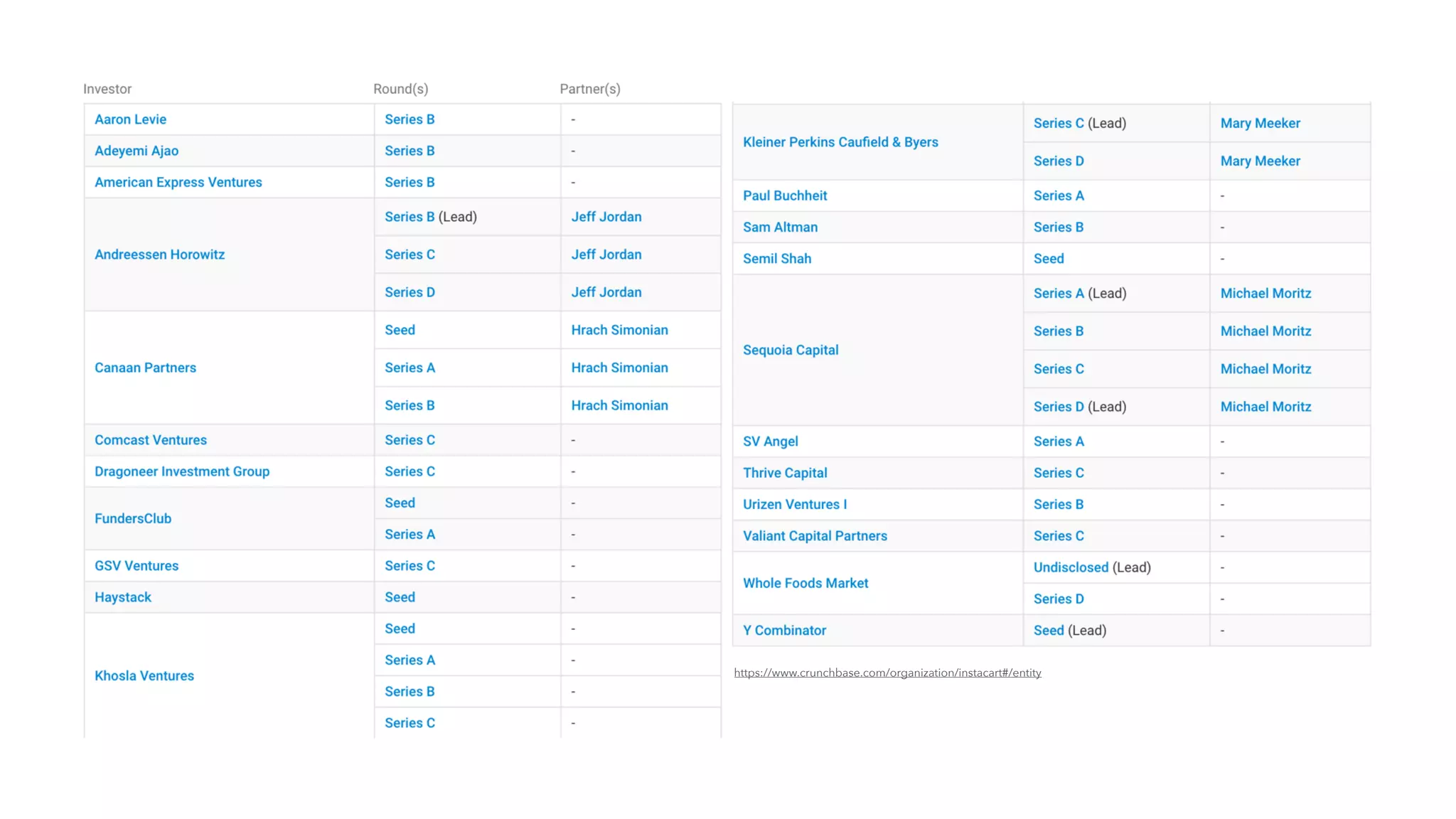

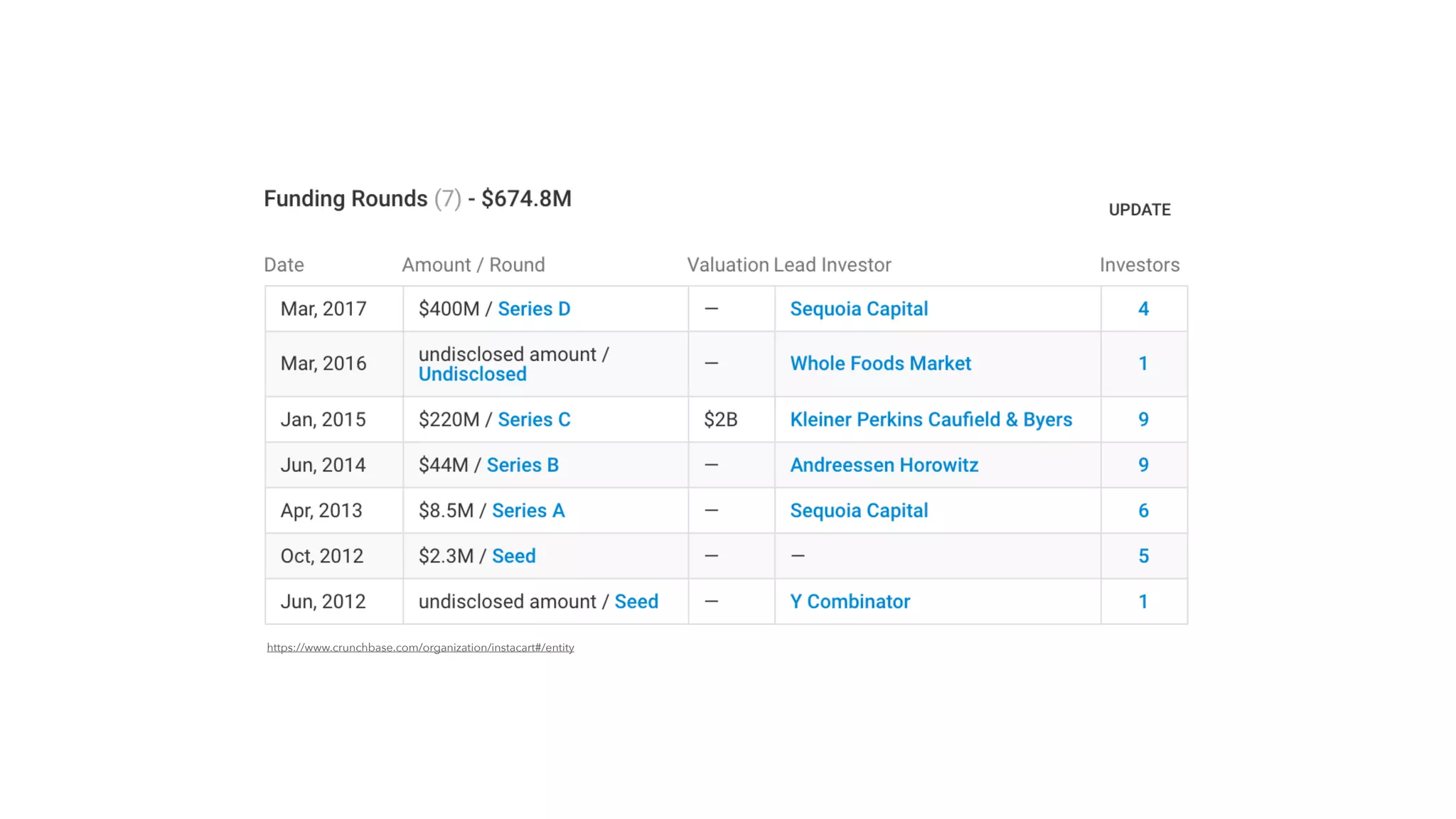

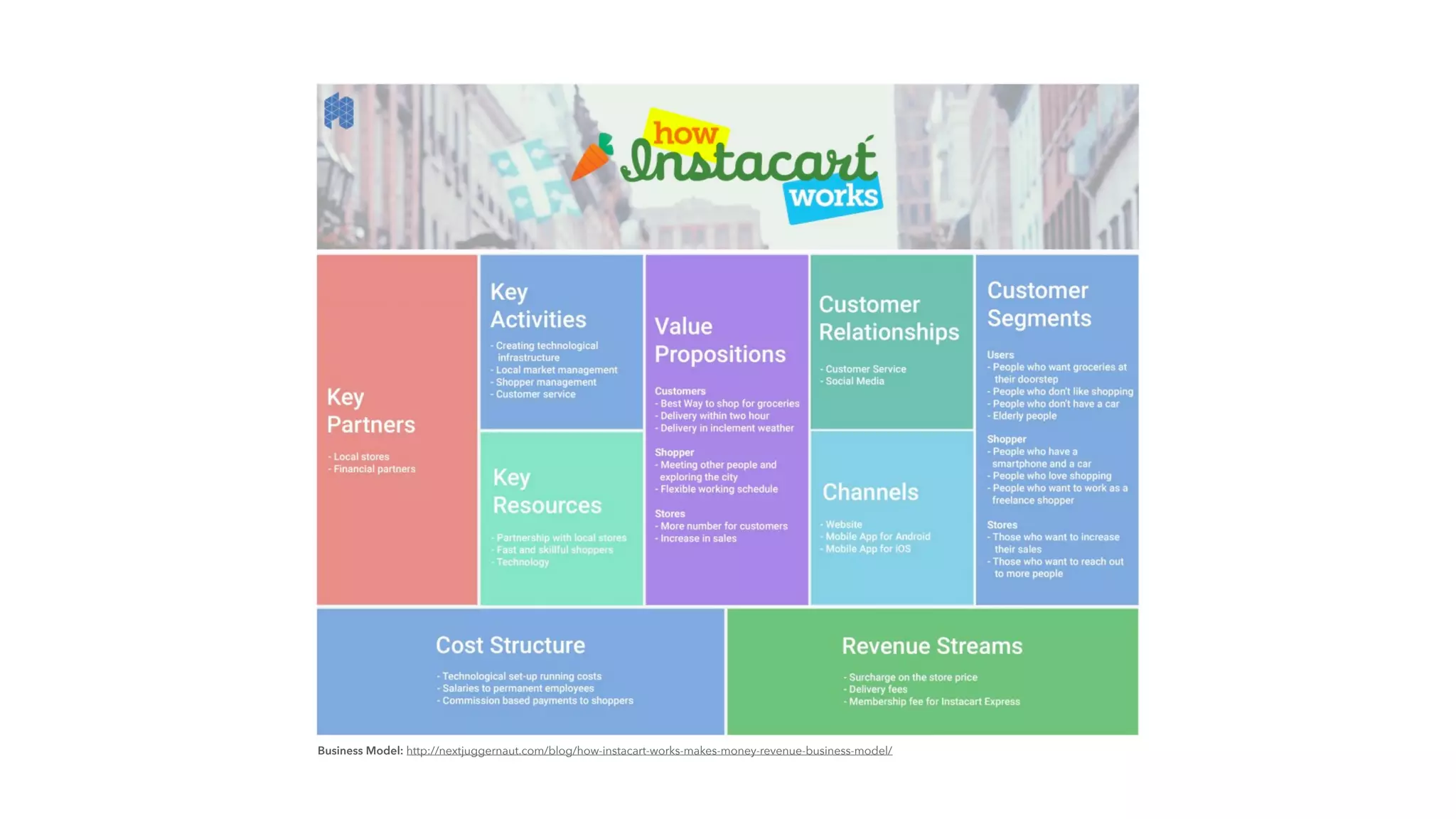

This deck balances brand, product clarity, investor evidence, operational detail, and honesty about crises. Its strengths are a one-line value proposition, simple conversion-focused product presentation, a clear fundraising timeline with reputable backers, a concise business model canvas, and explicit documentation of operational challenges plus fixes. These elements together demonstrate product-market fit and execution capability—critical signals for investors in capital-intensive marketplaces.

For founders preparing their own decks: lead with a crystal-clear single-sentence value proposition, show momentum with an easy-to-scan timeline, document investor validation and economics, map each marketplace participant with concrete features that solve their pain, and openly list top risks alongside concrete mitigations. Doing so turns a pitch from a marketing brochure into a credible plan for scaling and managing real-world complexity.