Cover & Value Proposition

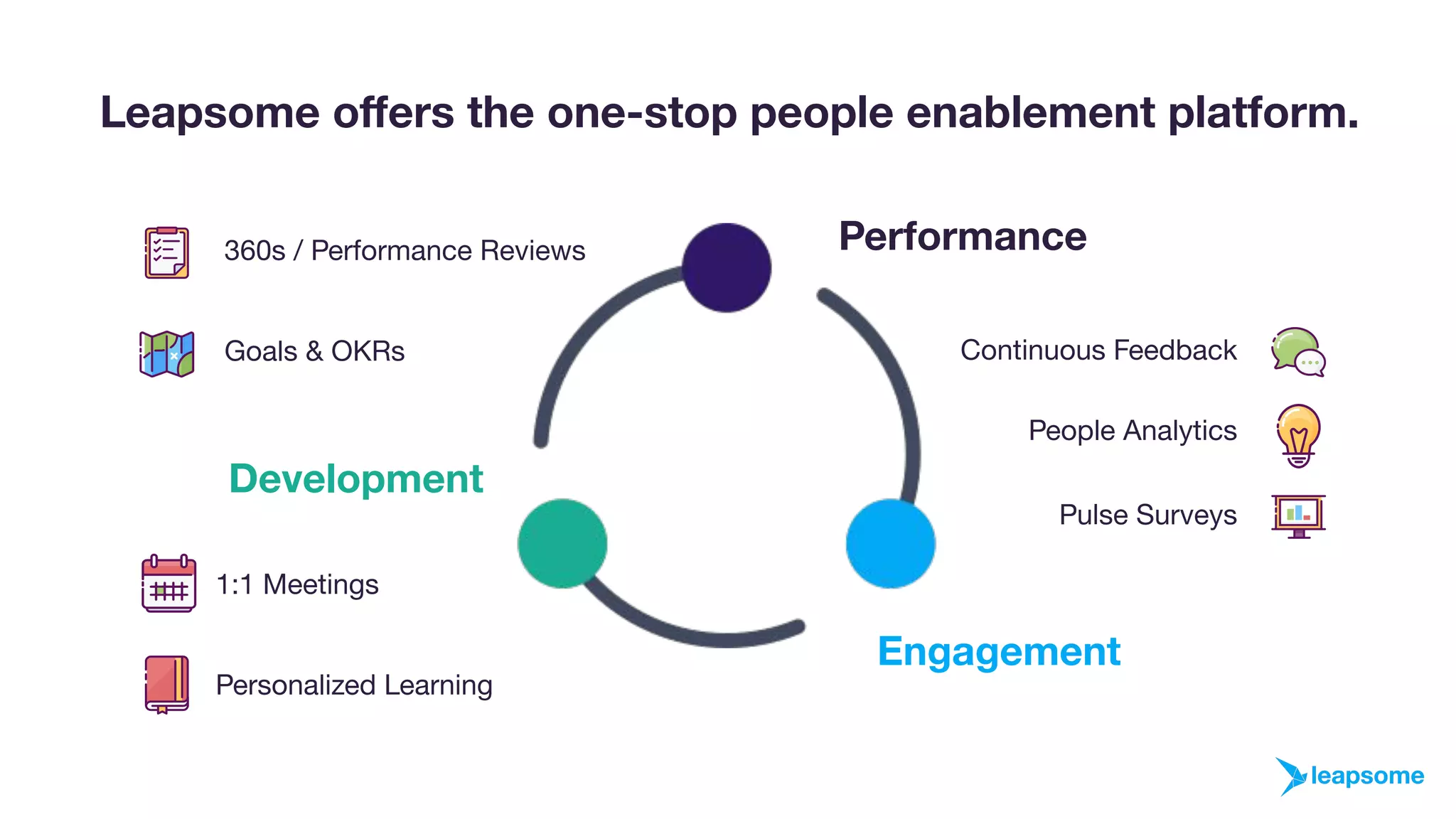

The opening slide (slide 1) is simple and direct: brand, tagline (“We help teams grow and succeed”), and short positioning (“The One-Stop People Enablement Platform”). This immediately communicates the mission without clutter and sets the expectation that the deck will explain how the product supports team growth across people processes. The minimalist design, with a faint product screenshot in the background, signals product-driven credibility while keeping the focus on the core message.

For founders: a clear, short value proposition on the first slide helps an investor decide quickly if the deck is relevant. The cover balances brand, mission, and product hinting — an effective pattern for SaaS companies selling to HR and C-suite buyers because it ties emotional benefit (teams succeed) to a practical promise (one platform).